415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

De

Veterans Serving Veterans

Serving With Pride!

New Jersey

Department of New Jersey

AMVETS

Veterans helping Veterans

Our services are and always have been provided

with dignity and respect to all miltary

regardless of race or background.

“one nation, under God, indivisible,

with libertyand justice for all”

AMVETS

WE SERVE AMERICA’S BEST

New Jersey AMVETS is veterans helping veterans to secure and preserve their entitlements and

benefits and advocate for additional benefits.

Our services include:

•

Helping veterans to obtain VA health care enrollment – file claims – obtain DD-214

•

Job bank

•

Suicide prevention advocacy

•

Fostering friendship with our veterans

Earned entitlements are important to us! The necessity of meeting Veterans needs is why we

continue to speak out on their behalf.

Our freedom is 'free to us' at the expense of VETERANS - the men and women who have served

selflessly - including those actively serving.

It's your time to lend a helping hand.

Veterans still fight upon returning home to receive their entitlements and healthcare -especially

those returning with disabililties and struggle to find their place back home.

AMVETS provides FREE services to assist our Veterans and YOU CAN HELP.

Please use these links to make a donation.

TOGETHER we can make a difference!!

We are a 501-C3 organization that welcomes tax deductible donations from individuals,

groups and corporations which allow us to continue our programs.

New Jersey AMVETS provides veteran and community programs. We provide support to our

New Jersey Veterans Homes and Veterans Haven.

Our programs include (but are not limited to):

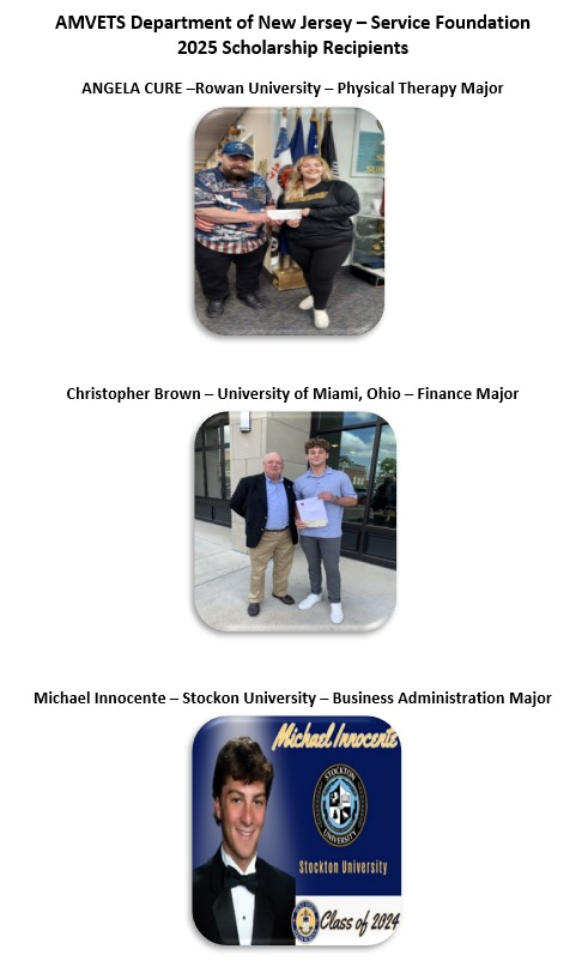

•Annual Scholarships to NJ AMVETS family members

•Care packages to our troops

•Awards to NJ High School ROTC students

•Americanism Contests offered to our local schools

•Community Programs and Veterans Memorial Services

American Veterans was chartered by Congress on July 23. 1947

PLEASE HELP SUPPORT OUR PROGRAMS! - CHECK THE DONATE MENU ABOVE FOR DONATION OPTIONS

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

AMVETS Department of New Jersey

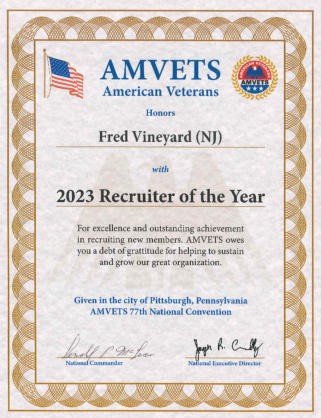

Fred Vineyard

Department Commander

WELCOME TO OUR WEBSITE

For more than 79 years, we in AMVETS have taken to heart the credo of service set forth by our organization’s

founding fathers.

In so doing, we endeavor to provide our fellow veterans with the type of support they truly deserve. This outreach

effort takes many forms, from the professional advice our service officers provide on earned veterans benefits, to our

legislative efforts on Capitol Hill, to the work done by our hospital volunteers.

Other AMVETS members involve themselves in a range of initiatives aimed at contributing to the quality of life in their

local communities.

These two areas—veterans service and community service—drive the commitment we have to make a difference in

the lives of others.

The pages of this website provide more detailed information on each area as well as a wealth of information for

veterans, their families and other interested citizens.

Please take a few minutes to review what makes New Jersey AMVETS the distinctive organization it is.

Our aim of building for a better America is an undertaking to which all can contribute.

NJ AMVETS is on the move and I invite you to join us!

Please review our Web site and let us know what you think!

We look forward to hearing your opinions and we will continually update our content to serve the interests of ALL

VETERANS

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

About Us

AMVETS is a Congressionally charted veterans organization dedicated to veterans, families, communities, and the

United States.

AMVETS traces its history back to World War II when returning veterans began organizing independent clubs. In 1944,

Colliers magazine published a special Veterans' Day issue to promote the clubs and their mutual aims: to promote

world peace, to preserve the American way of life and to help veterans to help themselves. A month later,

representatives of nine veterans' clubs met in Kansas City and forges a National organization - American Veterans of

World War II. The term "AMVETS" was coined by a newspaper reporter to fit a headline and adopted by the veterans

as their official name. In 1946 AMVETS petitioned Congress for a federal charter which was granted and signed into

law by President Truman on July 23, 1947.

Since then, the original charter has been amended several time to broaden eligibility criteria. Today, in recognition of

the sacrifices made by all veterans and service personnel, membership available to all honorably discharged veterans

who served on active duty, in the National Guard, Reserves, U.S. Coast Guard, and wartime U.S. Merchant Marine at

any time after September 15, 1940. Service men and women currently on active duty are also eligible.

AMVETS National Service Officers accredited by the V.A. provide free expert advice and claims assistance to veterans

and their families. AMVETS maintains an active legislative program and is a recognized presence on Capitol Hill.

AMVETS hospital volunteers contribute thousands of hours to brighten the lives of hospitalized veterans. Our National

Service Foundation donates thousands of dollars to Veterans Administration Medical Centers for medical equipment

and supplies. AMVETS actively supports Americanism, scholarships, driver safety, blood drives, organ donor programs,

Paws with a Cause and the Special Olympics.

As AMVETS begins its sixth decade of service, AMVETS will continue Serving with Pride the veterans, their country,

their communities and their families.

Preamble

AMVETS Constitution

We, the American Veterans who have served or are serving in the Armed Forces of the United States during and since

World War II, fully realizing our responsibilities to our community, to our state, and to our nation, associate ourselves

for the following purposes: To uphold and defend the Constitution of the United States, to safeguard the principles of

freedom, liberty, and justice for all; to promote the cause of peace and good will among the nations; to maintain

inviolate the freedom of our country; to preserve the fundamentals of democracy; to perpetuate the friendship and

associations of these veterans; and to dedicate ourselves to the cause of mutual assistance, this by the Grace of God.

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

Department of New Jersey

Constitution and By-Laws

AMVETS National Constitution and By-Laws

AMVETS National District One Constitution and By-Laws

AMVETS Department of New Jersey Constitution and By-Laws

AMVETS Service Foundation of New Jersey Constitution and By-Laws

New Jersey AMVETS Convention Rules

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

Membership

AMVETS Ladies Auxiliary

HELP TO INCREASE OUR AUXILIARY MEMBERSHIP

*Currently we have 2 New Jersey Posts with Ladies Auxiliary*

Letters of interest can be sent directly to the Post

NJ AMVETS Post 2

1290 Toms River Road, Jackson, NJ

NJ AMVETS Post 101

519 June Road, Pennsauken, NJ

Member-At-Large Membership available through National AMVETS

AMVETS National Ladies Auxiliary

4647 Forbes Blvd., Lanham, MD 20706

For more than 50 years AMVETS Ladies Auxiliary has served veterans

and their communities.

A network of AMVETS Ladies Auxiliary members across the country

provides a teamwork of support for local volunteers. Volunteering is

the heart of AMVETS Ladies Auxiliary. Volunteer services are

recognized through an extensive awards program both on the

department and national level.

Criteria for Membership

Membership applications are open to mothers, wives, widows,

grandmothers, sisters, daughters and granddaughters of AMVETS and

Female veterans who are currently serving or who have honorably

served in the Armed Forces of the United States, including the

National Guard and reserve components, any time after September

15, 1940.

*Applicants must be at least 18 years of age

*Membership criteria refers to National AMVETS Constitution,

ARTICLE XV: Ladies Auxiliary

*Note: Section 4, (a)”Each local Ladies Auxiliary shall be affiliated

with an AMVET Post and carry the corresponding number of that

post.”

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

Sons of AMVETS

Squadron 2 - Commander Ray Tower

Squadron 101 - Commander Jim Thoroughgood

ELIGIBILITY REQUIREMENTS

Eligibility for membership in the Sons of AMVETS shall be limited to all male

descendents, grandsons, adopted sons and stepsons, fathers, husbands, widowers,

and brothers of members of AMVETS and the deceased members of AMVETS, or

the personnel who died and would have been eligible for membership in the parent

organization, and are at least eighteen (18) years of age and is not eligible for

membership in the parent organization. This is not to include in-laws of any type.

SONS OF AMVETS PREAMBLE

We, the Sons of AMVETS (American Veterans), fully realizing our responsibility to

our parents, community, State and Nation, associate ourselves for the following

purposes:

To uphold and defend the Constitution of the United States of America;

To safeguard the principles of freedom, liberty and justice for all;

To promote the cause of peace and goodwill amongst nations;

To maintain the freedom of our country;

To preserve the fundamentals of democracy;

To perpetuate the friendships and associations of the AMVET

organization; and

To dedicate ourselves to the cause of mutual assistance...this by the

Grace of God.

Below are Membership Application Forms. If you are interested in joining, contact

the nearest AMVETS Post to learn more about the Sons of AMVETS and where the

nearest Sons Squadron is located.

https://sonsofamvets.org/

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

National District One

Officers and Meeting’s for the year 2025

…

Contact HQ for details

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

AMVETS Riders

AMVETS Riders are a dedicated and patriotic group of motorcycle riders who

hold true to an unwavering respect for our Nation, our flag and military Past, Present

and Future.

AMVETS Rider Chapter 2

President Eugene (Bud) La Corpte

1290 Tom River rd

Jackson N.J

AMVETS Rider Chapter 101

President Josh Gonzalez

519 June rd

Pennsauken NJ 08110

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

AMVETS License Plates

Below, find links to forms for ordering New Jersey AMVETS License Plates for your

vehicle.

NJMVC Form and Instructions

MUST BE A MEMBER OF AMVETS TO APPLY

NOT AVAILABLE FOR LEASED VEHICLES

Branch Specific Plates can be ordered by contacting NJMVC Special Plates Unit 609-292-6500 ext. 5061

*Plates will be mailed to your home. There is no pickup at the NJDMV required*

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

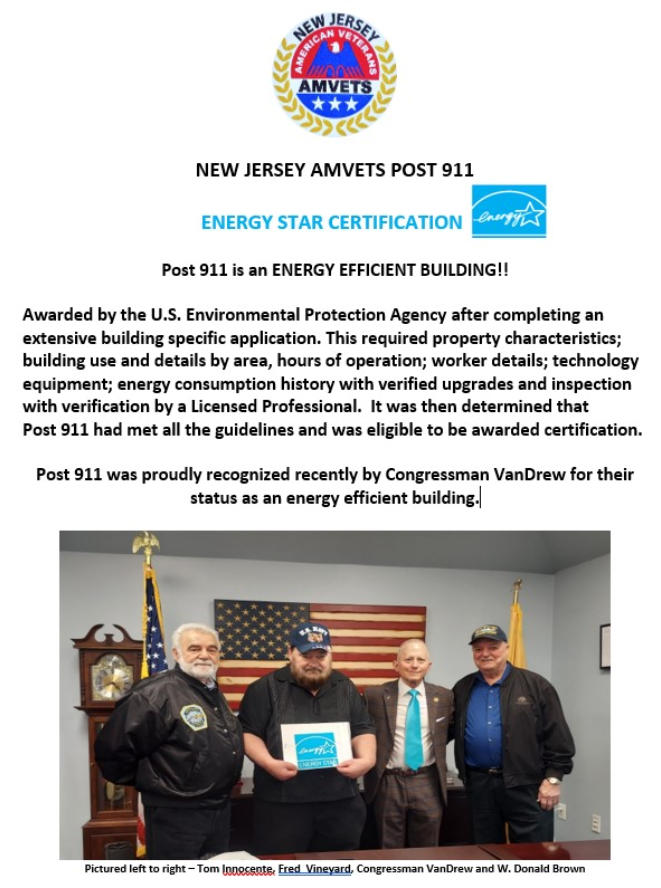

AMVETS DEPARTMENT OF NEW JERSEY SERVICE FOUNDATION

Dear AMVETS Member and Friends of AMVETS,

Our Service Foundation is constantly expanding our Veterans Support Programs. We currently provide programs at the New Jersey VA Medical Centers,

NJ Veterans Homes and Veterans Haven.

The cost associated with continuing these programs continues to increase and we are in need of your donations so that we can move forward with

offering our Veterans Programs.

WE NOW HAVE A NEW MISSION

A new generation of Veterans needs our support. Many of our troops return home with combat related injuries and our support programs will assist in

securing the benefits they have earned.

We must also address the growing needs of care for mental health as Veterans cope with the difficulty of adjusting to their return home; those facing

homelessness and providing family and caregiver support.

AMVETS is Veterans Serving Veterans

Your tax deductible donation is appreciated as we move forward in service to our Veterans. Our New Jersey Charities Registration is 4035-03926.

*Please consider checking with your employer to see if they may have a matching fund program.

Donations are accepted by check or online at the links provided.

PayPal

Pledge

===================================================================================================================

I support AMVETS Department of New Jersey Service Foundation

Please accept my donation of $100____ $50____ $25____ Other____

Name____________________________________

Address__________________________________

City/State/Zip_____________________________

*Checks payable to: AMVETS Dept. of NJ Service Foundation

Mail to: 415 Shore Road, Somers Point, NJ 08244

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

Planned Giving

Pledge A Donation

Planned Giving Basics: What Is a “Planned” Gift?

Planned giving is a term commonly used to describe a wide variety of donation

options that allow you to contribute to New Jersey AMVETS during your lifetime, or

after your death, while at the same time addressing your current income needs

and/or your desire to provide for your heirs. Planned gifts are usually contemplated

by donors when they draw up their estate plans. However, the process of amending

these arrangements at a later date to include charitable giving is a relatively

uncomplicated one.

From a donor perspective, planned giving is attractive for many reasons. Certain

planned giving vehicles generate income for defined periods or for life, offer higher

yields than commercial investments, and result in reduced capital gain and estate

taxes. Planned gifts are a viable option for those donors who are uncertain how

much of their assets they will need to support themselves and their families during

their lifetimes, especially during retirement years.

The most common types of planned gifts are bequests, life insurance policy

designations, gifts of retirement fund assets, Charitable Remainder and Charitable

Lead Trusts, and Charitable Gift Annuity agreements.

What Are My Planned Giving Options?

Charitable Bequests

The term "charitable bequest" is used to describe any assets that you leave New

Jersey AMVETS from your estate through your will or a trust. You can arrange to

bequeath a gift from your estate in several different ways. You can set aside a

specific dollar amount, leave a percentage of your estate, or donate any assets left

over after your family has been provided for. At the time of your death, the value of

the assets you designate to New Jersey AMVETS will be eliminated from your

taxable estate.

Life Insurance Policy Designation

By designating New Jersey AMVETS as either the primary or a contingent

beneficiary of your life insurance policy, 401(k) Plans and Retirement Funds

Whom Do I Contact?

For more information about how a planned gift might fit into your overall giving to

New Jersey AMVETS as well as your financial plans, please contact:

New Jersey AMVETS

415 Shore Road

Somers Point, NJ 08244

Telephone 609-526-4356

Note: NJ AMVETS Strongly encourages the consultation with a professional legal

advisor when preparing a will. This should not be used as legal advise

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

Veterans In Need of Assistance

CRISIS LINE 800-273-8255

Veterans Crisis Line/National Suicide Prevention is now available by dialing 988 - then press 1

This provides easy access to veteran-specific mental health support.

**the previous number 800-273-8255 remains active as well**

Angelic Home Health Care 609-418-4948 (Atlantic/Cape May/Cumberland Counties)

E-mail: info@angelic.health

Atlantic County Special Registry 609-909-7847

www.acsnr.org

Caregiver Support 855-260-3274

yvww.caregiver.va.gov

Catholic Charities 856-261-1177 (Atlantic/Cape May Counties)

www.catholiccharitiescamden.org

DRNJ (Disability Rights New Jersey) Intake Unit 800-922-7233/609-292-9742

www.DRNJ.org

E-mail advocate@disabilityrightsnj.org

Heroes on the Water Programs 214-295-4541

www.heroesonthewater.org

E-mail: info@heroesonthewater.org

Jewish Family Service 609-822-1108 (Atlantic & Cape May Counties)

Meadowview Nursing and Rehabilitation Center 609-645-5955

Accepts eligible Veterans for all levels of care including long-term and end of life

New Jersey Department of Military Affairs 609-530-4600

www.nj.gov/military

New Jersey Mission of Honor for Cremains of American Veterans 201-906-1592

www.njsmissionofhonor.org

Operation First Response - Serving Wounded Heroes and Families 888-289-0280

E-mail: info@operationfirstresponse.org

Superior Court of New Jersey 609-421-6100

Veterans Administration 800-827-1000 www.va.gov

VA Health Benefits 877-222-8387

Veterans Haven South - transitional housing 609-561-0269/609-567-5806

Veterans Multi-Service Center HQ- 215-923-2600 South Jersey/Delaware 856-293-7321

Visiting Angels Home Care 609-641-7200

VETERANS SERVICE OFFICER - Fred Vineyard 609-526-4356/609-626-2675

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

Veterans Programs and Services

Veteran Affairs: http://www.va.gov/

Branches of the Federal Government

The Executive Branch - The White House: www.whitehouse.gov

The Legislative Branch - The United States Senate: www.senate.gov

The Legislative Branch - The United States House Of Representative: www.house.gov

Military Branches

The Pentagon: www.defenselink.mil/pubs/pentagon

The United States Army: www.army.mil

The United States Navy: www.navy.mil

The United States Marine Corps: www.usmc.mil

The United States Air Force: www.af.mil

The United States Coast Guard: www.uscg.mil

The American Merchant Marines: www.usmm.org

Military Academies

United State Military Academy: www.usma.edu

United States Naval Academy: www.nadn.navy.mil

United States Merchant Marine Academy: www.usmma.edu

United States Coast Guard Academy: www.cga.edu

United States Air Force Academy: www.usafa.af.mil

United States Air Force ROTC: www.afoats.af.mil

General / Misc Resources

Federal Executive Branch Resources: www.loc.gov/global/executive/fed.htm

Federal Judiciary Branch Resources: www.uscourts.gov

Memorial and Tribute Web Sites / Military Memorials:

Korean War Veterans Memorial: www.nps.gov/kowa

Vietnam Veterans Memorial: www.nps.gov/vive/index.htm

National World War II Memorial: www.wwiimemorial.comArizona

Memorial Museum Association www.nps.gov/usar

United State Air Force Museum: www.wpafb.af.mil/museum

Arlington National Cemetery: www.arlingtoncemetery.org

American Memorial Park: www.nps.gov/amme/main.htm

Societies

Congressional Medal Of Honor Society: www.cmohs.org

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

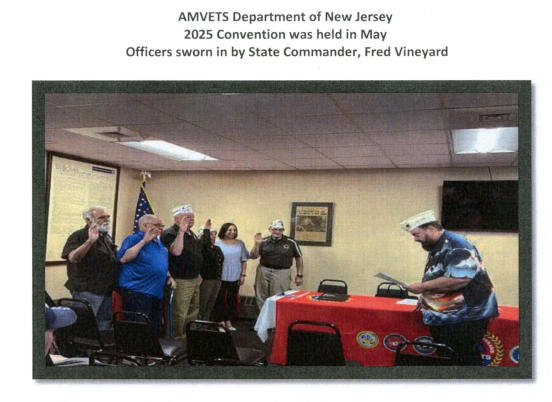

State Department Officers and Trustees

Don Brown

1st Vice Commander

Bruce Dinardo

2nd Vice Commander

John Kill

3rd Vice Commander

Chineider Ferreira

State Adjutant

Vicki Rago

Finance Officer

Tom Innocente

Judge Advocate

Don Brown

Alternate NEC

Fred Vineyard

NEC

Ron Bird

Provost Marshall

Fred Vineyard

Legislative Director

John Ackley

Chaplain

Fred Vineyard

Veterans Service Officers

Fred Vineyard

Department Commander

2025-2026

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

Service Foundation Officers and Trustees

ONE YEAR TRUSTEES

Frank Fries

John Ackley

TWO YEAR TRUSTEES

John Kill

Chinerderi Ferreira

THREE YEAR TRUSTEES

Don Brown

Tom Innocente

State Commander

Fred Vineyard

Tom Innocente

President

2025-2026

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

New Jersey Veteran Centers

All centers open Monday - Friday 8:00AM - 4:30PM

Bloomfield Veteran Center

2 Broad St., Suite 703

Bloomfield, NJ 07003

(973) 748-0980

Trenton Veteran Center

934 Parkway Avenue Suite 201

Ewing, NJ 08618

(609) 882-5744

Lakewood Veteran Center

1255 Route 70; Unit 32N, Parkway Seventy Plaza

Lakewood, NJ 08701

(732) 905-0327

Secaucus Veteran Center

100A Meadowlands Pkwy Suite 102

Secaucus, NJ 07094

(201) 223-7787

Atlantic County Veteran Service

201 S Shore Rd

Northfield, NJ

(609) 677-5700

Veteran Benefits Web Sites List

Combat Call Center 1-877-WAR-VETS (1-877-927-8387)

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

NJ Certified Service Officers

Courtney Johnson

Nutley Health and Veteran Bureau

Township of Nutley, NJ

973-284-4976

Monday- Friday 9:30- 3:00pm

Robert L. Frolow, Veterans Services Officer

201 S. Shore Road, Ground Floor

Northfield, NJ 08225

Phone (609) 677-5700

Fax: (609) 677-5705

Fred Vineyard, Veterans Service Officer

415 Shore rd

Somers point NJ 08244

For Appointment, Please e-mail Fav1126005@aol.com

Veterans Multi-Service Center

New Jersey VMC

serving Southern NJ

616 Landis Ave, Suite 2, Vineland, NJ

856-293-7321

VA Medical Center Locations

We are pleased to produce the following information to assist all veterans in locating

VA Medical Care facilities and New Jersey Veterans Memorial Homes.

Hospitals

East Orange VA Medical Center

385 Tremont Avenue, East Orange, NJ 07018

(973) 676-1000

Lyons VA Medical Center

151 Knollcroft Road, Lyons, NJ 07939

(908) 647-0180

Philadelphia VA Medical Center

3900 Woodland Avenue, Philadelphia, PA 19104

(800) 949-1001

Wilmington VA Medical Center

1601 Kirkwood Highway, Wilmington, DE 19805

(302) 994-2511

New Jersey Veterans Nursing Homes

Veterans Memorial Home - Menlo Park

132 Evergreen Road, Menlo Park, NJ 08818-3013

(732) 452-4100 (Main Telephone Number)

(732) 454-4272 (Menlo Park Admissions Officer)

Veterans Memorial Home - Paramus

1 Veterans Drive, Paramus, NJ 07652

(201) 634-8200 (Main Telephone Number)

(201) 634-8435 (Paramus Admissions Officer)

Veterans Memorial Home - Vineland

524 North West Boulevard, Vineland, NJ 08360-2895

(856) 405-4200 (Main Telephone Number)

(856) 405-4261 (Vineland Admissions Officer)

Meadowview Nursing Home

235 Dolphin Avenue, Northfield, NJ 08255

(609) 645-5955

Filing a claim with the Veterans Administration

Step 1: Consult With Your National Service Officer

Talk with your Service Officer about the condition for which you are considering filing a claim. If, as a result of your discussion with the service officer, the claim

appears warranted, go to:

Step 2: Collect Documentation.

Gather the following documents to support your claim:

•

Service medical records

•

Private physician’s records

•

Applicable photographs

•

DD Form 214

•

Marriage certificate

•

Birth certificates of children

•

Copies of dependents’ Social Security cards

After assembling these records and forms, take...

Step 3: Contact Your Service officer, Again.

Discuss with the service officer your findings and what more, if anything, needs to be done to document your claim.

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

Applications for the Veteran Property Tax Deduction of $250.00 may be obtained

from the Tax Assessor's Office.

$250 Veterans Proprty Tax Deduction (Form V.S.S.)

Link to Requirements Page

Disabled Property Tax Relief (Form D.V.S.S.E.)

Veterans Income Tax Form

NJ Veterans Tax Deduction

- Veterans in need of assistance

- Veterans Clinics

- New Jersey Vet Centers

- Service Officers Hospitals Vet Homes Locations

- Apply for VA Healthcare

- NJ Veterans Tax Deduction

- New Jersey Veterans Legislation

- Legal Assistance for Veterans

- VA Benefits

- AMVETS Jobs

- Bridging the Gap

- Bright Star Jobs

- NJ Veteran Tax Guide

- Heroes on the Water NJ Chapter

- Veterans Programs and Services

- AMVETS License Plates

415 Shore Road, Somers Point NJ 08244

Office: 609-526-4356

Website: www.amvets-nj.org

Facebook: https://www.facebook.com.newjerseyhq

Instagram: https://www.instagram.com/njamvets

HQ open Monday/Tuesday/Wednesday 9am-3pm

Service Officer available call Fred Vineyard 609-526-4356

New Jersey Military and Veterans Legislation

New law allows injured veterans to recoup erroneous severance taxes

Service And Guide Dogs

Bill to Exempt Vets' Organizations from State Filing Fee Now Law

Bill to Create ‘NJ Stolen Valor Act’ Advances - Cape May County Herald

New Law Concerning hiring preference for veterans

Act concerning the burial of indigent veterans (Sponsored by New Jersey AMVETS)

Burial Allowances

NJ MVC Veteran's Honorary Designation

Income Tax Exemption for Veterans

VA Announces Rollout and Application Process for New Veterans ID Card

Veterans Exemption Form

P.L. 2019, CHAPTER 469

New Jersey Global War on Terrorism Medal

Act excluding combat pay from gross income taxation

Governor signs Dancer Bill

Legislation to Help Veterans More Easily Obtain Nursing Licensure

I am pleased to present New Jersey legislation that pertains to veterans. I will continually update this information as

it changes. Legislation that has passed into law will appear at the end of this listing.

Active Duty Military Personnel and Veterans

New Jersey provides special consideration for active duty military personnel. Special privileges are also available for

service-disabled or blind veterans (see below).

License extensions

If you are on active military duty and have been deployed, including New Jersey National Guard and Reserve, you and

your immediate family are entitled to automatic extensions for your driver's license, registration and inspection

requirements.

Your license, registration and inspection documents will remain valid for as long as you are deployed..

When you are demobilized, you will need to renew your expired documents within 90 days of your

demobilization date or return from duty.

Law enforcement officials are aware of this extension. Please carry the Administrative Order along with your

active duty military credentials at all times when operating a vehicle. See Related Links below for extension

instructions to obtain the Deployed Military Administrative Order.

Registration refunds

If you enter or are an active member of the U.S. Armed Forces and have a valid New Jersey registration, you can get

a refund for the remainder of the registration period.

To obtain a refund:

Write a letter to the Motor Vehicle Commission (MVC) stating the reason you are requesting a refund along

with proof of service.

Complete and return a refund form (RU-9). Refund forms are also available at motor vehicle agencies or by

calling the MVC's Customer Support Line at 609- 292-6500 weekdays (except holidays) from 8:30 a.m. to 4:15

p.m..

Return the original registration and the New Jersey license plates along with a copy of military orders and a

copy of the out-of-state registration.

Service-disabled or blind veterans

You may qualify for free registration, if you meet the following classifications:

Are without sight as a result of war service and eligible for compensation from the State under N.J.S.A. 38:18-

1.

Currently have another service-connected disability and have qualified for a free automobile from the US

Veterans Administration and:

o

You have a valid New Jersey driver's license or a generated driver's license number.

o

The vehicle in question is equipped with special attachments or devices that may be necessary for its

safe operation.

o

The vehicle is properly insured by a New Jersey licensed company.

To apply for free registration, call 609 292-6500 extension 5076 for an application.

Mail the certified application with affixed seal or stamp of the U.S. Veterans Administration to:

New Jersey Motor Vehicle CommissionGovernment UnitP.O. Box 016Trenton, New Jersey 08666-0016

Once the free registration status has been established, all subsequent renewals can be completed at a motor vehicle

agency, or through the mail in the envelope provided.

Disabled Veteran, Purple Heart Recipient Placards

Jersey law (N.J.S.A. 39:4-207.10) permits exemption from payment of municipal parking meter fees, for up to 24

hours, for disabled veterans and Purple Heart recipients under certain, specific circumstances. For more information,

click here.

We are required to capture a customer’s full face when taking a picture for a driver license or non-driver ID card;

therefore we need to be able to see from the top of your forehead to the bottom of your chin. If you have a

medical or religious need to wear a head covering in your photo, please advise the MVC staff at the

agency camera station.

Winner: New Jersey veterans

Several bills intended to help the state’s veterans, particularly those who became disabled during their service, were

approved by lawmakers during the lame duck, including a measure signed into law by Christie on Monday.

The new law creates a 5-year pilot program that would issue grants to nonprofit groups to make improvements to the

homes of disabled veterans, such as wheelchair ramps, accessible bathrooms and energy efficient equipment to

reduce utility costs.

The bill appropriates $5 million from the state’s general fund over the five-year program.

Income Tax Exemption for Veterans

New for Tax Year 2017. You are eligible for a $3,000 exemption on your Income Tax return if you are a military

veteran who was honorably discharged or released under honorable circumstances from active duty in the Armed

Forces of the United States by the last day of the tax year. Your spouse (or civil union partner) is also eligible for an

exemption if he/she is a veteran who was honorably discharged or released under honorable circumstances and you

are filing a joint return. This exemption is in addition to any other exemptions you are entitled to claim and is

available on both the resident and nonresident returns. You cannot claim this exemption for a domestic partner or for

your dependents.

Providing DocumentationYou must provide a copy of Form DD-214, Certificate of Release or Discharge from Active

Duty, the first time you claim the exemption.This form does not need to be provided each year. The United

States National Archives and Records Administration can assist with obtaining a copy of your DD-214.

You can certify for the exemption by sending a copy of your DD-214 and Veteran Exemption Submission Form to the

Division before you file, which may help process your return faster. To certify:

Use our secure document upload feature to submit your DD-214 and Veteran Exemption Submission Form.

Enter the notice code VET and select PO Box 440; or

Mail a copy of your DD-214 and Veteran Exemption Submission Form to: The New Jersey Division of Taxation,

Veteran Exemption, PO Box 440, Trenton, NJ 08646-0440; or

Fax your DD-214 and Veteran Exemption Submission Form to 609-633-8427.

If you do not certify before you file for the exemption, you will need to submit a copy of your DD-214 when you file

using:

A Paper Return. Enclose a copy of your DD-214 with your return;

NJ Fill’nFile. Upload your DD-214, along with all of your other documentation, into the repository;

Other Electronic Filing Methods. If you file your return using NJ WebFile, third-party software (such as

TurboTax), or you have a tax professional who electronically submits your return, you can send a copy of your

DD-214 and Veteran Exemption Submission Formusing one of the three certification methods listed above.

National Guard and Reserve Finally Get 'Veteran' Status

New Jersey NEW Tax deduction for Veterans 2017

The tax deal introduced a $3,000 tax deduction for veterans.

The law defines veterans as those who are "honorable discharged or released under honorable circumstances from

active duty in the Armed Forces of the United states, a reserve component thereof, or the National Guard of New

Jersey in a federal active duty status."

Here's how 8 N.J. laws taking effect Jan. 1 might affect you | NJ.com

Tax Exemptions for Disabled Veterans by State

Jersey Disabled Veterans Real Estate Tax Exemption

NJDVSSE

Press Release: NJHA, UHF Announce $1.35M Grant to Bolster Veterans’ Mental Health Initiatives in New

Jersey.

For Immediate Release

PRINCETON, N.J. (June 13, 2016) – The New Jersey Hospital Association (NJHA) and United Health Foundation

brought together health professionals and military leaders today to raise awareness about the complexities of

managing veterans’ health and examine ways to improve access to care through innovative partnerships and

community engagement.

The forum, “Managing the Complexity of Veteran Health: Serving Those Who Have Served,” highlighted a

$1.35 million partnership between NJHA’s Health Research and Educational Trust (HRET) and United Health

Foundation to bolster veteran health programs, including the hiring of additional Veteran Navigators to facilitate

access to high-quality, community-based mental health, behavioral health and supportive services for

veterans and military families in underserved areas of the state. The forum was attended by U.S.

Representative Tom MacArthur (NJ-3), Lt. Governor Kim Guadagno, New Jersey Department of Military and Veterans

Affairs Adjutant General Michael Cunniff and Assemblymember Cleopatra Tucker (28-LD).

United Health Foundation Partnership with New Jersey Hospital Association Helping Veterans and Service Members

Navigate Health Services to Improve Access to Care

Veteran Navigators hired through $1.35 million partnership grant are helping connect veterans,

service members and their families to health services and programs in communities throughout

New Jersey

Forum brings together care providers and military leaders to raise awareness about managing the

complexity of veteran health

“Veterans and military families face unique health needs, and it is often a challenge for them to access the care and

programs that help ensure they receive quality care,” said Betsy Ryan, president and CEO of the New Jersey Hospital

Association. “This partnership with United Health Foundation is providing valuable resources that are helping raise

awareness and improving the health and wellness of our veterans and service members.”

According to the National Institutes of Health, military service members and veterans face health issues differently

than civilians. The stressors of being in combat, combined with being separated from family, can put service members

and veterans at risk for mental health problems. These include anxiety, post-traumatic stress disorder (PTSD),

substance abuse and depression that, in extreme circumstances, can lead to suicide. According to a study

commissioned by the Military Officers Association of America (MOAA) and United Health Foundation, there is a

preparedness gap among most community-based mental health providers in being able to take care of the special

needs of military veterans and their families.

Through its partnership with United Health Foundation, NJHA is using a peer-to-peer model with Veteran Navigators

to connect with their fellow service members to facilitate access to the care that veterans and their families need.

“The work of NJHA is improving access to care for veterans and military members,” said New Jersey Lt. Gov. Kim

Guadagno. “NJHA’s partnership with United Health Foundation is the type of public-private approach that will make a

difference in the lives of our neighbors, particularly those with the greatest needs.”

“Helping veterans and their families with support to improve their quality of life is mission critical,” said Michael

Cunniff, Adjutant General, New Jersey Department of Military and Veterans Affairs. “Our service members, veterans

and their families often face unique challenges to care including having access to care providers who understand their

specific needs. By raising awareness and having veterans engage directly with service members and their families, we

are helping improve their personal health and recovery.”

During the forum, guest speakers discussed important health topics facing veterans and military service members

including military culture, injury and recovery programs, PTSD, suicide prevention and navigating the VA system,

among others. NJHA provided an overview and update on how the organization is working collaboratively with other

partners in the state to implement a comprehensive model to close the gap between providers and veterans through

efforts that increase awareness of available support, and improve skills of mental health professionals in addressing

veteran-specific issues and needs.

U.S. Rep. Tom MacArthur (NJ-3) praised the work on behalf of veterans and service members. “I applaud the work of

all the organizations gathered today for this important forum that is raising awareness about improving care for our

veterans and service members who have sacrificed so much for our nation. It is important to help connect our troops

with the programs and care they need, particularly given the unique situations they face. Programs like this are

model initiatives that bring together the best minds and organizations to forge solutions to care.”

The Veteran Navigators, along with the entire project team at NJHA, are being cross-trained in Mental Health First

Aid, Health Coaching and supplemental topics with an opportunity to become Certified Prevention Specialists to help

meet the unique needs of military service members and their families

“This partnership between NJHA and United Health Foundation is helping to ensure that our military men and women

understand the programs and services available to them to improve their care and quality of life,” said Heather

Cianfrocco, President, Northeast Region, UnitedHealthcare. “The Veteran Navigators are a critical resource,

understanding their experiences and their needs, and helping to alleviate the stresses that our nation’s service

members, veterans and their families endure every day.”

About NJHA and the Health Research & Educational Trust

The New Jersey Hospital Association is a healthcare trade organization that helps hospitals and post-acute care

providers deliver affordable, accessible and quality healthcare to their communities. The Health Research and

Educational Trust of New Jersey is a nonprofit affiliate of NJHA. It provides leadership and resources to improve the

healthcare delivery system and health of the community. Its mission is to develop research projects and educational

initiatives that promote quality, affordable and accessible healthcare and raise public and provider awareness about

vital healthcare issues.

About United Health FoundationThrough collaboration with community partners, grants and outreach efforts,

United Health Foundation works to improve our health system, build a diverse and dynamic health workforce and

enhance the well-being of local communities. United Health Foundation was established by UnitedHealth Group

(NYSE: UNH) in 1999 as a not-for-profit, private foundation dedicated to improving health and health care. To date,

United Health Foundation has committed more than $285 million to programs and communities around the world. We

invite you to learn more at www.unitedhealthfoundation.org or follow @UHGGives on Twitter or

Facebook.com/UHGGives.

Contacts:

Kerry McKean Kelly L.D. Platt

New Jersey Hospital Association United Health Foundation

(609) 275-4069 (202) 654-8830

kmckean@njha.com LD_Platt@uhg.com

Veteran EMT Support Act signed into law

Trained military medics will be put on an accelerated track to receive state EMT certification and licensure

Aug 4, 2016

WASHINGTON — New legislation will help military veterans with medic training to transition into the civilian

workforce, helping to address a shortage of EMTs.

The Veteran Emergency Medical Technician Act of 2016, H.R. 1818, was signed into law with the Comprehensive

Addiction and Recovery Act (CARA) in late July.

The bill was a key priority of the National Association of Emergency Medical Technicians, who will help create a

transition program for trained military medics to meet state EMT certification and licensure requirements.

"The Veterans EMT Support Act is an important step forward to help veterans in their transition back to civilian life,

while improving emergency care in our communities," said Rep. Lois Capps, D-California one of the officials who

introduced the bill. "These heroes have proven their skills on the battlefield. It is only right that we break down any

artificial barriers that delay or prevent them from serving our communities here at home."

CARA aims to address the growing opioid addiction epidemic by authorizing nearly $900 million over the next five

years to support education, prevention and law enforcement efforts.

The bill was formally signed into law on July 23.

President Signs Veterans Legislation Into Law

On Tuesday, June 7, 2022, President Biden signed nine bills into law related to veterans and the

Department of Veterans Affairs (VA).

S. 1760, which designates the community-based outpatient clinic of the Department of Veterans

Affairs planned to be built in Oahu, Hawaii, as the Daniel Kahikina Akaka Department of

Veterans Affairs Community-Based Outpatient Clinic;

S. 1872, the “United States Army Rangers Veterans of World War II Congressional Gold Medal

Act,” which provides for the award of a Congressional Gold Medal to the United States Army

Rangers Veterans of World War II, in recognition of their dedicated service during World War II;

S. 2102, the “Dr. Kate Hendricks Thomas Supporting Expanded Review for Veterans In Combat

Environments Act” or the “Dr. Kate Hendricks Thomas SERVICE Act,” which expand eligibility for

VA mammography screening to veterans who served in locations associated with toxic

exposures;

S. 2514, which renames the Provo Veterans Center in Orem, Utah, as the Col. Gail S. Halvorsen

“Candy Bomber” Veterans Center;

S. 2533, the “Making Advances in Mammography and Medical Options for Veterans Act,” which

makes a number of changes to VA’s mammography screening and access to related medical

care;

S. 2687, the “Strengthening Oversight for Veterans Act of 2021,” which temporarily authorizes

the Department of Veterans Affairs’ Office of Inspector General to issue subpoenas in certain

circumstances;

S. 3527, which authorizes VA to transfer to another property the name of a VA property that

was named in statute;

S. 4089, the “Veterans Rapid Retraining Assistance Program Restoration and Recovery Act of

2022,” which restores entitlement to educational assistance under the Veterans Rapid

Retraining Program under certain conditions; Thank you to Senator Durbin and Representatives

Danny Davis and Underwood for their leadership; and

S. 4119, the “RECA Extension Act of 2022,” which extends by two years the availability of

compensation for radiation exposure related to nuclear weapons development.

P.L.2021, c.37.A2244

Approved 3/15/2021

Revises provisions of State law concerning claiming and proper disposal of cremains of veterans and eligible spouses or dependents.

P.L.2021, c.49.S275

Approved 4/19/2021

Provides resident tuition rate to certain non-resident dependent children of United States military personnel attending public institutions of

higher education.

P.L.2021, c.56.S2815

Approved 4/19/2021

Requires DMVA assist service members discharged solely due to LGBTQ status with petitions to change discharge designation.

P.L.2022, c.59.A1455

approved 7/5/2022

Permits county clerk or register of deeds and mortgages to issue identification card to Gold Star Family Member.

P.L.2021, c.174.S278

Approved 7/22/2021

Establishes certain rights for students with military obligations attending public institutions of higher education and permits late

registration for students with military obligations.*

P.L.2021, c.175.S956

Approved 7/22/2021

Extends veterans' property tax exemption to tenant shareholders in cooperatives and mutual housing corporations.

P.L.2021, c.176.S961

Approved 7/22/2021

Establishes annual grant program to recognize institutions of higher education that offer comprehensive array of veteran programs and

services.*

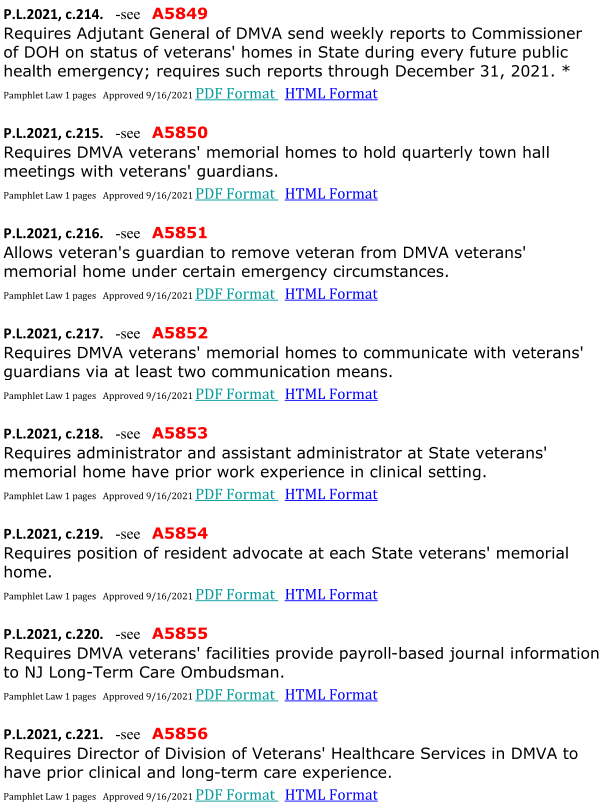

P.L.2021, c.214.A5849

Approved 9/16/2021

Requires Adjutant General of DMVA send weekly reports to Commissioner of DOH on status of veterans' homes in State during every future

public health emergency; requires such reports through December 31, 2021. *

P.L.2021, c.215.A5850

Approved 9/16/2021

Requires DMVA veterans' memorial homes to hold quarterly town hall meetings with veterans' guardians.

P.L.2021, c.216.A5851

Approved 9/16/2021

Allows veteran's guardian to remove veteran from DMVA veterans' memorial home under certain emergency circumstances.

P.L.2021, c.217.A5852

Approved 9/16/2021

Requires DMVA veterans' memorial homes to communicate with veterans' guardians via at least two communication means.

P.L.2021, c.218.A5853

Approved 9/16/2021

Requires administrator and assistant administrator at State veterans' memorial home have prior work experience in clinical setting.

P.L.2021, c.219.A5854

Approved 9/16/2021

Requires position of resident advocate at each State veterans' memorial home.

P.L.2021, c.220.A5855

Approved 9/16/2021

Requires DMVA veterans' facilities provide payroll-based journal information to NJ Long-Term Care Ombudsman.

P.L.2021, c.221.A5856

Approved 9/16/2021

Requires Director of Division of Veterans' Healthcare Services in DMVA to have prior clinical and long-term care experience.

P.L.2021, c.241.A3123

Approved 9/28/2021

Allows veteran or personal representative to withdraw honorable discharge papers from county clerk.

P.L.2021, c.300.A4861

Approved 11/8/2021

Requires DOH to publish total number of COVID-19 deaths and cases in long-term care facilities.*

P.L.2021, c.340.S2817

Approved 1/10/2022

Allows active duty service members to provide document other than DD-214 when claiming veterans' preference for civil service.

P.L.2021, c.429.A259

Approved 1/18/2022

Provides civil service preference to military service members who did not serve in theater of operation but received campaign or expedition

medal.

P.L.2021, c.435.A1121

Approved 1/18/2022

Upgrades certain crimes of misrepresenting oneself as member or veteran of US Armed Forces or organized militia.

P.L.2021, c.470.A5694

Approved 1/18/2022

Permits dependents of military member to enroll in school district in advance of military member's relocation to district.

P.L.2021, c.474.A6012

Approved 1/18/2022

Appropriates $500,000 for USS New Jersey Commissioning Committee to support commissioning of boat and assigned personnel.

P.L.2022, c.59.A1455

Approved 7/5/2022

Permits county clerk or register of deeds and mortgages to issue identification card to Gold Star Family Member.

P.L.2022, c.84.S875

Approved 8/2/2022

Requires Division of Medical Assistance and Health Services in DHS to accept permanent change of station order for purposes of satisfying

residency requirement for provision of home and community based services under certain circumstances.

P.L.2022, c.105.A1477

Approved 9/15/2022

Increases allowance paid to war veterans with certain service-connected disabilities.

P.L.2022, c.108.A3694

Approved 9/15/2022

Establishes "Purple Star Schools Program" in DOE to recognize schools which emphasize importance of assisting children of military

families. *

P.L.2022, c.125.A655

Approved 12/5/2022

Exempts discharge of student loan debt of certain veterans through the federal Total and Permanent Disability discharge process from

taxation under the gross income tax.

P.L.2022, c.126.A325

Approved 12/12/2022

Authorizes military service members, spouses, and dependents with out-of-state domicile to operate motor vehicles in New Jersey.

P.L.2023, c.17.A2493

Approved 3/10/2023

Defines indigent veteran and veteran status for certain veteran interment purposes.

P.L.2023, c.18.A2722

Approved 3/10/2023

Permits veteran to receive credit toward licensure as licensed practical nurse upon completing certain military medical training programs.

Summary of Fiscal Year 2023 Appropriations for Veterans Affairs, Programs and Related Agencies

The Military Construction, Veterans Affairs and Related Agencies bill (H.R. 2617, (P.L. 117-328). The FY2023 Consolidated Appropriations Act)

for fiscal year 2023, provides the Department of Veterans Affairs (VA) and related agencies with $135.2 billion in non-defense discretionary

funding, as well as $168.6 billion in mandatory funding. This is $34 billion above fiscal year 2022 levels. The bill further provides advance

appropriations for fiscal year 2024, including $128.1 billion for veterans' medical care and $155.4 billion for veterans' benefits.

Department of Veterans Affairs (VA) – $134.7 billion in discretionary appropriations for VA, an increase of $22.5 billion above the fiscal year

2022 enacted level and $328.7 million below the President’s budget request:

•

$118.7 billion for Veterans Medical Care, an increase of $21.7 billion above the fiscal year 2022 enacted level and equal to the

President’s budget request. This will provide care for 7.3 million patients expected to be treated by VA in fiscal year 2023. This amount

includes:

•

$13.9 billion for Mental Healthcare, including $498 million for suicide prevention outreach. This will support the nearly 2 million

veterans who receive mental health services in a VA specialty mental health setting, as well as support suicide prevention services like the

Veterans Crisis Line.

•

$2.7 billion for Homeless Assistance Programs. This funding will enhance VA’s ability to reach homeless veterans.

•

$337 million Rural Health, $10 million more than fiscal year 2022, to support improved access to care, including expanded access to

transportation and telehealth.

•

$1.9 billion for Caregivers, $493 million more than fiscal year 2022, to help VA implement this program consistent with Congressional

intent.

•

$840.5 million for Women’s Health, equal to fiscal year 2022, for gender-specific healthcare services, as well as initiatives and

improvements to healthcare facilities.

•

$183.3 million for Substance Use Disorder programs. This funding will help support care for the over 540,000 veterans who had a

substance-use disorder diagnosis in 2021. Additionally, $663 million is for opioid abuse prevention, an increase of $41 million above the

fiscal year 2022 enacted level and equal to the budget request.

•

$86 million for Whole Health Initiatives. This will enable VA to expand and improve a program that focuses on veterans’ overall health

and well-being.

•

Additionally, $128.1 billion in advance of fiscal year 2024 funding for Veterans Medical Care, equal to the President’s budget request.

This funding will provide for medical services, medical community care, medical support and compliance, and medical facilities.

VA Non-Medical Care Programs - VA non-Medical Care programs, which are $1.2 billion above the fiscal year 2022 enacted level. This

amount includes:

•

$916 million for Medical and Prosthetic Research, an increase of $34 million above the fiscal year 2022 enacted level and equal to

the President’s budget request. This funding will allow VA to fund approximately 2,697 total projects and partner with more than 200

medical schools and other academic institutions.

•

$1.76 billion for VA Electronic Health Records Modernization, to continue implementation of the VA Electronic Health Record

Modernization initiative, $741 million below the fiscal year 2022 enacted level and equal to the President’s budget request.

•

$3.86 billion for operating expenses of the Veterans Benefits Administration, an increase of $409 million above the fiscal year 2022

enacted level and equal to the President’s budget request, to ensure the prompt processing of disability claims and efforts to continue

reducing the disability claims backlog.

•

$2.1 billion for VA Construction programs, equal to the President’s budget request. Within this amount, $1.45 billion is for Major

Construction and $626 million is for Minor Construction.

•

$150 million for Grants for Construction of State Extended Care Facilities, an increase of $100 million above the fiscal year 2022

enacted level and equal to the President’s budget request. This increase will allow VA to provide more grants to assist states in constructing

state home facilities, for furnishing domiciliary or nursing home care to veterans, and to expand, remodel, or alter existing buildings.

•

$5 billion in new mandatory funds for the Cost of War Toxic Exposures Fund, established to support costs related to providing

veterans and their families with the benefits and care associated with the eligibility expansions included in the Honoring our Promise to

Address Comprehensive Toxics (PACT) Act of 2022 (P.L. 117-168).

•

Additionally, $155.4 billion in advance mandatory funding for VA benefit programs.

Related Agencies - $442.7 million in discretionary appropriations for related agencies, an increase of $8.5 million above the fiscal year 2022

enacted level and $700,000 above the President’s budget request. This amount includes:

•

$156 million for Arlington National Cemetery, including $60 million to continue the urgently needed Southern Expansion project that

will create 80,000 additional burial spaces. This is equal to the President’s budget request.

•

$87.5 million for the American Battle Monuments Commission, equal to the fiscal year 2022 enacted level and $700,000 more than

the President’s budget request. This will support continued maintenance of the graves of 124,000 American war dead in overseas

cemeteries, as well as visitor and education services for the more than 3 million visitors expected to visit these sites in fiscal year 2023.

•

$152 million for the Armed Forces Retirement Home, $75 million above the fiscal year 2022 enacted level and equal to the President’s

budget request. This will support the needs of the over 800 residents at the two retirement home campuses and invest in life and safety

infrastructure improvements, including construction funds for the renovation of the main resident building on the Washington campus.

•

$46.9 million for the Court of Appeals for Veterans Claims, $5.2 million above the fiscal year 2022 enacted level and equal to the

President’s budget request. This increase supports the planned temporary expansion, which will improve the court’s capacity to adjudicate

appeals in a timely manner.

Additional Veterans Bills

Cleland-Dole Act – TheJoseph Maxwell Cleland and Robert Joseph Dole Memorial Veterans Benefits and Health Care Improvement Act of

2022 will:

•

Expand eligibility for VA hospital care, medical services, and nursing home care to include all veterans of World War II.

•

Establish a clinical pathway for prostate cancer, along with increased research.

•

Cut bureaucratic red tape for veterans who receive clothing allowances. These veterans will no longer need to reapply annually.

•

Increase oversight of health care providers to ensure veterans receive high quality care.

•

Improve measurements of wait times for the community care program and pilot scheduling.

•

Extend eligibility for GI Bill and Veterans Readiness and Employment (VR&E) during national emergencies so educational benefits are

not left unused.

STRONG Veterans Act - The Support the Resiliency of Our Nation’s Great (STRONG) Veterans Act of 2022 is a comprehensive mental health

package that addresses mental health care provided by the VA, including provision to:

•

Strengthen VA’s mental health care workforce, expand care options, and support mental health research at the Department.

•

Improve the Veterans Crisis Line’s (VCL) staff training, management, and response to veteran callers at risk of suicide.

•

Strengthen the Solid Start program, which was created by VA in 2019 to contact every veteran three times by phone in the first year

after they leave active duty service to check-in and help connect them to VA programs and benefits.

•

Designate one week per year as “Buddy Check Week” to organize outreach events and educate veterans on how to conduct peer

wellness checks.

•

Expand VA’s peer specialist support program, established through the VA MISSION Act, to all VA medical centers.

•

Expand Vet Center eligibility for counseling and related mental health services to family members of servicemembers or veterans of

the Armed Forces who died by suicide.

•

Require VA to report to Congress on the Department’s Veterans Integration to Academic Leadership (VITAL) program and assess the

number of VA medical centers, institutions of higher learning, non-college degree programs, and student veterans supported by the

program.

•

The package also includes provisions to improve mental health outreach to Native American veterans and minority veterans, bolster

VA’s outreach to justice-involved veterans, expand Vet Center eligibility to student veterans, and allow Native American tribes to participate

in VA’s Governors’ Challenge veteran suicide prevention program.

Please go to Congress.gov to view Fiscal Year 2023 Appropriations for Veterans Affairs, H.R. 2617, (P.L. 117-328

Click the link below to log in and send your message:

https://www.votervoice.net/BroadcastLinks/kw-tvYfsgQxYRL_GKYqeDw

On June 14, 2023, the president signed into law S. 777, the Veterans’ Compensation Cost-of-Living Adjustment Act of 2023, which authorizes

a cost-of-living adjustment (COLA) for veterans receiving Department of Veterans Affairs (VA) disability compensation, clothing allowance,

and survivors receiving dependency indemnity compensation (DIC) payments. To view Public Law 118-6, click here.

VA adjusts veterans’ monthly disability compensation amounts based on the yearly change in the cost of living as determined by the Social

Security Administration (SSA). Later this year, SSA will announce the exact percentage of increase. We will inform you of the percentage

when it is announced. The COLA adjustment will be effective December 2023, and will be reflected in January 2024 compensation payments.

Governor Murphy Signs Legislation Allowing Certain Veterans to Keep Special

Military License Plates Upon Conclusion of Service

Service Members Civil Relief ACT

The Servicemembers Civil Relief Act provides financial and legal protections for active-duty service members, including National

Guard and reserve members, and their families. Because details of the SCRA are complicated, service members and their

families are encouraged to contact the nearest legal assistance office if they need help meeting their financial obligations.

•

Reduced interest rates — Creditors must reduce the interest rate on debts to 6% for liabilities incurred before you entered

active duty. If the debt is a mortgage, the reduced rate extends for one year after active-military service. The reduced interest

rate applies to credit card debts, car loans, business obligations, some student loans and other debts, as well as fees, service

charges and renewal fees. Creditors can challenge this provision if they believe your ability to pay a rate higher than 6% is not

materially affected by your military service.

•

Postponement of foreclosures — No sale, foreclosure or seizure of property for nonpayment of a preservice mortgage

debt is valid if made during or within nine months after your service on active duty, unless carrying out a valid court order.

This can provide tremendous protections from foreclosure in the many states permitting foreclosures to proceed without

involving the courts. If you miss a mortgage payment, you should contact your legal assistance office immediately.

•

Deferred income taxes — The Internal Revenue Service and state and local taxing authorities must defer your income

taxes due before or during your military service if your ability to pay the income tax is materially affected by military service.

No interest or penalty can be added because of this type of deferral.

•

Eviction prevention — You and your family cannot be evicted for nonpayment of rent without a court order regardless of

the language of your rental agreement or local laws. This protection applies to residences where the monthly rent is below a

certain amount. Contact your nearest legal assistance office for the most up-to-date figures. If your ability or your family’s

ability to pay rent is materially affected by your military service, you may apply to the court, and the court must either grant a

90-day delay in eviction proceedings or adjust obligations under the lease in a way agreeable to all parties.

•

Protection against default judgments — If, while on active duty, a civil action, a civil proceeding or an administrative

proceeding is filed against you, the judge must appoint a lawyer to represent you in your absence. The court must grant a

delay, or stay, of at least 90 days if it determines there may be a defense to the action and the defense cannot be presented

without your attendance.

•

Postponed civil court matters — If you cannot participate in a civil court action or administrative proceeding because of